The importance of Human Resource (HR) budgets and cost management in preparation for 2025

When discussing HR budgets, planning is just as crucial as budgeting for any other operational area in an organisation. It forms the foundation of why organisations succeed.

An HR budget outlines the financial resources allocated to human resources activities within a year. This includes salaries, benefits, training, and other expenses associated with developing and retaining employees. Preparing an HR budget involves systematically collecting company-wide HR data to project the financial support needed for the organisation’s operations.

In today’s challenging economic environment, where many companies face significant obstacles, running a business without clear financial planning is unsustainable. Organisations must streamline, prioritise, and develop a concise HR budget that aligns with their capacity. This ensures they can effectively manage their most valuable asset, the people, while minimising financial losses.

Budgeting for HR requires a comprehensive collection of data, including the number of employees, benefit costs, projected turnover rates, current year expenses, and new benefit program plans.

HR budgeting can generally be categorised into three main approaches:

- Incremental Budgeting: This method involves making minor adjustments to the previous year’s budget, suitable for organisations with existing HR budgets.

- Zero-Based Budgeting: In this approach, the budget is built from scratch for the upcoming year, with each expense requiring detailed justification.

- Flexible Budgeting: Though more time-intensive, this method enables optimal resource allocation and helps identify inefficiencies or opportunities for improvement.

Effective HR budgeting is critical for any organisation aiming to remain sustainable, attract top talent, and ensure long-term business viability.

Impact of economic conditions and global trends on HR budgeting strategies

The Nigerian economy, like many others, is deeply influenced by global downturns and broader global trends.

Best Practices for HR Budgeting in Challenging Times

- Strategic Alignment with Organisational Goals: HR cannot function in isolation; its projects and budgets must align with the organisation’s overall strategic objectives. Start by understanding the company’s priorities for the upcoming year and ensure that the HR budget supports these goals. Viewing HR from a business perspective ensures that its initiatives contribute directly to the organisation’s success.

- Leverage Historical Data and Strategic Analysis: Analyse historical HR budgets and expenditures, identify any variances, and understand their causes. Use this data to inform future planning. For example, in a struggling economy, it’s crucial to have open communication and collaboration with HR stakeholders, including managers, departmental heads, and other decision-makers. Identify the most pressing HR needs, prioritise them, and involve all relevant parties to create a cohesive plan.

- Categorise Expenses Effectively: Group HR expenses into clearly defined categories, such as personnel costs, payroll, taxes, equipment, and training. Determine which categories require immediate attention and prioritise accordingly.

- Focus on Value Addition: Invest in strategic hires who can deliver immediate and measurable value to the organisation. The goal isn’t merely to fill positions but to ensure that new hires align with the organisation’s overall objectives. Consider how each hire can contribute meaningfully to the company’s success.

- See Economic Downturns as Opportunities: Economic challenges can also present opportunities. As the Chinese proverb suggests, “In every problem lies an opportunity.” Redirect resources and efforts toward areas that can be productive, ensuring employees contribute meaningfully to organisational goals. Proper budget management in such times allows you to focus on initiatives that bring tangible results and long-term benefits.

By aligning HR strategies with organisational goals, leveraging data for informed decision-making, and prioritising value-driven initiatives, organisations can navigate economic challenges effectively and emerge stronger.

Key components of an HR budget and how budgeting affects recruitment, especially when it comes to payment of prospective salaries.

HR budgeting encompasses several critical components that work together to ensure effective resource management and alignment with organisational goals. Understanding these key elements is vital for creating a comprehensive HR budget that aligns with strategic priorities and delivers tangible value to the organisation.

Key Components of HR Budgeting

- Personnel Costs: Personnel costs are the largest component of the HR budget, covering salaries, wages, bonuses, and employee benefits. These costs are fundamental and must be budgeted appropriately, regardless of whether the organisation adopts an incremental or zero-based budgeting approach. Proper consideration of personnel costs is essential to ensure that resources are allocated effectively.

- Recruitment and Onboarding Expenses: These expenses include costs related to sourcing, hiring, and integrating new employees into the organisation. They cover advertising fees, recruitment agency charges, background checks, training, and onboarding. However, recruitment should not be undertaken just for the sake of it or as an annual routine. Each hire must fulfill a specific need and add measurable value to the organisation. Where possible, internal talent should be leveraged, emphasising talent management to optimise the existing workforce rather than seeking external candidates unnecessarily.

- Prioritising Talent Retention: Retaining top talent is critical to maintaining a strong, resilient workforce. Organisations should prioritise initiatives that enhance employee satisfaction, engagement, and loyalty, ensuring that their workforce remains motivated and aligned with business objectives.

- Integration of Business Technology: Organisations should explore opportunities to integrate IT solutions into HR processes. Automating repetitive tasks and outsourcing non-core activities can enhance efficiency and reduce costs. A holistic approach to HR ensures that staff remain engaged, motivated, and supported while minimising operational losses and maintaining business profitability.

By focusing on these components, organisations can craft an HR budget that not only supports operational needs but also contributes to long-term sustainability and growth.

Top of Form

Bottom of Form

Common mistakes organisations make when planning HR budgets.

- Lack of Alignment with Overall Business Strategy: A clear understanding of what budgeting entails is essential for effective HR budgeting. If HR budgets are not aligned with the organisation’s overall objectives, it can lead to conflicts with management and hinder the achievement of strategic goals.

- Failure to Document Appropriately: Accurate and reliable data is the cornerstone of effective budgeting. One major challenge in HR budgeting is ensuring the quality and availability of data used for analysis and projections. Factors such as outdated systems, manual data entry, data silos, lack of integration, and human errors can compromise data accuracy and reliability.

- Excluding Stakeholders from the Process: Stakeholder engagement and collaboration are critical for successful HR budgeting. HR must work closely with stakeholders across the organisation to gather insights and align the budget with specific departmental needs. For instance, budgeting for training programs without consulting the head of engineering might overlook critical needs, such as safety or mental health training. Engaging stakeholders ensures that budgets are relevant and impactful.

- Budgeting Without Factual Basis: Relying on assumptions or guesswork instead of data-driven insights can undermine the budgeting process. Effective budgeting requires a thorough understanding of projected revenues, associated costs, and personnel expenses. Conversations with key departments, such as finance and revenue teams, are essential to ensure that budgets are realistic and aligned with organisational goals.

- Neglecting Emergency Savings and Flexibility: Rigid budgeting practices, such as simply applying incremental adjustments to previous budgets (e.g., adding 5% or 25%), fail to account for unforeseen changes. Effective budgeting requires flexibility and the ability to adapt to emergencies or shifts in strategic priorities. Aligning budgets with organisational objectives and incorporating contingency plans is essential to maintain agility and sustainability.

By addressing these common pitfalls, HR teams can create budgets that are accurate, aligned, and responsive to organisational needs.

Major drivers in HR, and how they can be managed effectively

Today, numerous factors influence HR practices, driving the need for adaptability and innovation. Key drivers include alignment, efficiency, scalability, productivity, governance, and sustainability.

- Redefinition of work itself: Work is no longer confined to a specific place, employees don’t necessarily go to work; instead, they perform their tasks from anywhere. This shift has led to changes in workforce dynamics, the adoption of new technologies, and the rise of the Gig economy. Consequently, HR transformation now involves equipping managers with real-time tools to engage employees and address the demands of a flexible and remote workforce.

- Hybrid Talent Management: The objective of organisational development remains to acquire the right talent with the right skills. However, talent management must now embrace hybrid approaches, accommodating diverse working styles and preferences rather than relying on rigid, traditional models.

- Predictive Analytics and Dynamic Engagement: Predictive analytics has become essential in employee experience and talent management. Similarly, employee engagement must evolve to reflect the diversity of today’s workforce. For instance, the engagement needs of employees in their 50s or 60s differ significantly from those in their 20s. HR must adopt tailored strategies to engage these groups effectively.

- Global Perspective, Local Execution: In a world that has become a global village, organisations frequently operate across borders. HR must think globally while acting locally, harmonising global strategies with local practices to align with current trends and ensure relevance.

By addressing these drivers, HR can stay ahead of the curve, creating systems that are agile, inclusive, and aligned with the demands of a rapidly changing workforce.

How organisations can balance investments in employee welfare with cost optimisation.

Differentiating between cost and investment in HR is crucial. Human Resource should not be seen as a cost center but as a strategic investment in employees. Costs are expenses aimed at maintaining current operations, while investments are expenditures focused on improving future revenue or reducing costs. Striking a balance between these two approaches is essential for sustainable growth.

When organisations invest in employee welfare, it is not merely for the benefit of the employees but for the overall success of the business. Employees who are engaged, motivated, and focused contribute their best, leading to higher productivity. For instance, wellness programs like meditation sessions, fitness challenges, and skill-enhancing training can reduce stress, improve efficiency, and lower operational costs. These are not just expenses; they are investments that yield tangible returns over time.

How to Balance Investments with Costs

- Conduct Cost Analysis: Before committing to any expense or investment, it is essential to perform a thorough cost analysis. This helps in evaluating whether the expenditure will add value or unnecessarily strain resources.

- Evaluate Employee Value: Consider the contributions of employees to the organisation. Are they pivotal to driving the company forward? If certain employees are not aligned with the organisation’s needs, it may be better for them to explore opportunities elsewhere where their talents are better utilised. This ensures that the workforce remains productive and aligned with business goals.

- Strategic Investments in Talent: Identify high-potential employees and invest in their development. Focus on initiatives that enhance efficiency and engagement while maintaining a balanced approach. Strategic investments in employee growth will ultimately be reflected in improved organisational performance.

By viewing HR as an investment and making informed, strategic decisions, organisations can foster a productive workforce while achieving long-term sustainability and success.

Innovative trends and approaches to HR cost management.

The lifeblood of any organisation is its people, making them both its greatest asset and its most significant expense. To justify these expenses daily, organisations can adopt strategic approaches to optimise costs while maintaining quality and efficiency. Here are some strategies:

- Strategic Hiring: Prioritise candidates’ skills over their previous job titles or degrees. This approach can uncover untapped potential, enabling the organisation to meet its needs effectively while potentially lowering recruitment costs.

- Employee Referral Programs: Encourage current employees to refer qualified candidates. This not only reduces recruitment expenses but also ensures a higher likelihood of cultural fit and productivity.

- Flexible Work Arrangements: Reevaluate traditional work schedules. For instance, why require employees to work from 8 a.m. to 4 p.m. if their tasks can be completed earlier? Flexible hours orreduced workdays, such as a four-day workweek, can improve efficiency and work-life balance while reducing overhead costs.

- Outsourcing Non-Core Functions: Outsource tasks like cleaning, driving, or certain IT operations that do not require stringent in-house control. This can significantly reduce recurring expenses, as these services can be paid for on a one-off or contract basis. Additionally, leveraging technology-driven solutions to automate routine tasks can streamline operations and cut logistics costs.

By implementing these strategies, organisations can effectively manage their workforce-related expenses while fostering a productive and engaged team.

Advice to HR professionals or business leaders struggling with budget constraints.

Enhancing budget accuracy requires a multifaceted approach that ensures clarity, strategic focus, and alignment with organisational goals. Here are key steps to achieve this:

- Clear Communication and Team Involvement: Foster open communication within your team, clearly define your goals, and involve team members throughout the budgeting process. For instance, if your goal is to allocate and spend one billion this year, begin by analysing past trends, where you started, where you stopped, and what changes are needed.

- Set Priorities: Clearly outline what you aim to achieve and the purpose behind it. For example, instead of merely planning training programs, determine how the training aligns with your organisational goals. Define the “why” before deciding on the “how” and “what.”

- Strategic Alignment: Approach budgeting with a purpose. Just like planning a major life decision, such as marriage, ensures there is a clear reason and outcome. Without a defined purpose, the process risks falling apart.

- Practical Planning: Adjust your plans based on available resources rather than aspirations. As the saying goes, “cut your coat according to your cloth.” Focus on achievable objectives without overextending resources or compromising the organisation’s stability.

- Balance Short-Term and Long-Term Investments: While long-term investments are important, they must not jeopardise immediate operations or the organisation’s ability to generate small but necessary profits.

- Evaluate whether long-term investments could disrupt current cash flow or operational stability.

- Prioritise investments that maintain a balance between operational continuity and strategic growth.

By prioritising clear goals, fostering team collaboration, and balancing immediate needs with long-term strategies, organisations can create accurate budgets that support sustainable growth and operational efficiency.

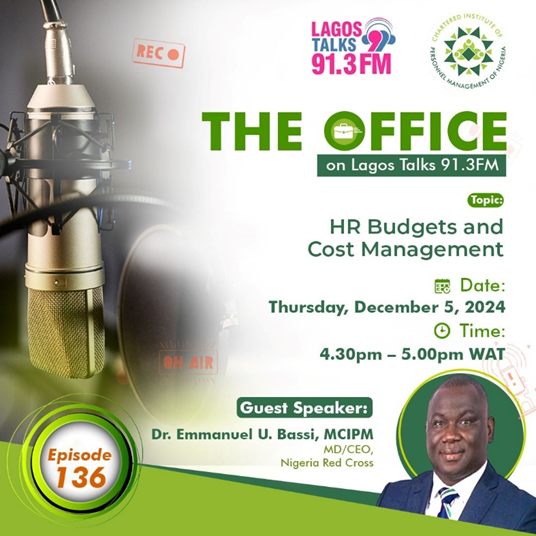

“This thought leadership piece is culled from the CIPM radio programme, ‘The Office.’ The opinions expressed in this article are solely those of the Guests and do not represent the views of CIPM.”