Overview

The Nigerian Tax Reform Act, recently enacted, is more than just a matter of compliance; it touches every payroll, every office, and every desk. For HR practitioners, the pressing question is: what do these changes truly mean? Are they merely regulatory adjustments, or could they become catalysts for boosting morale, driving productivity, and reshaping workplace culture?

On June 26, 2025, President Bola Ahmed Tinubu signed four landmark tax reform bills into law:

- The Nigerian Tax Act

- The Tax Administration Act

- The Nigerian Revenue Service (Establishment) Act

- The Joint Revenue Board (Establishment) Act

Together, these laws represent a sweeping overhaul of Nigeria’s tax system, designed to spur economic growth, strengthen revenue generation, and modernise tax administration nationwide.

The challenge for HR is how these reforms can be turned into a strategic advantage. The opportunity lies in aligning compliance with innovation, regulation with opportunity, and uncertainty with growth. Research shows that organisations that proactively manage the impact of tax reforms on employees can increase productivity by up to 20%. Conversely, poor management can erode motivation and efficiency. This is where HR emerges as a true game changer. As Peter Drucker once observed, “The most valuable resource of the 21st-century institution will be its knowledge, its knowledge workers, and their productivity.”

New Federal Government Tax Reform: Its Impact on Employee Productivity and the Role of HR

The four major tax reform bills signed into law by President Bola Ahmed Tinubu mark a significant shift in Nigeria’s fiscal landscape, with far-reaching implications for employees, employers, and HR practitioners.

From the employee perspective, many are concerned about how the new laws will affect them in the workplace, particularly how to apply the provisions accurately to ensure they neither overpay nor underpay their taxes. For employers, the focus lies on understanding potential incentives and compliance requirements relating to employee taxation.

There is still some uncertainty about the ultimate impact of these reforms. However, with implementation set to begin on 1st January 2026, the focus has shifted to preparation. State revenue authorities are expected to review and update their operational guidelines and frameworks to ensure compliance with the new laws, particularly in relation to taxes remitted at the State level.

Tax practitioners are preparing to support individuals and organisations through the transition, providing guidance and clarifications as the new fiscal system comes into effect. Although some challenges are expected during the first six to twelve months of implementation, the reforms are broadly regarded as marking the beginning of a new era for Nigeria’s tax system.

For HR executives and leaders, this period is pivotal in fostering employee awareness and understanding of the new tax regime. HR functions should take an active role in engaging staff through small team discussions and company-wide briefings, clearly explaining the implications of the reforms. Organisations can further support employees by developing Frequently Asked Questions (FAQs) and simple Excel-based tax simulations to illustrate how the changes will affect take-home pay.

Importantly, low- and middle-income earners stand to benefit under the new tax law. Lower-income employees, particularly those earning the minimum wage, will see their tax obligations significantly reduced, sometimes eliminated entirely. Middle-income earners will also experience moderate relief, ensuring their disposable income remains stable.

In contrast, high-income earners, especially those with annual earnings of ₦180 million or more, will need to carefully reassess their tax positions. Strategic tax planning will be essential to maintain compliance and optimise efficiency under the new system.

Employees may experience fears and uncertainties as they await clarity on the next steps under the new tax reform. To address this, HR professionals must remain well-informed and proactive as updates emerge. Close collaboration with finance experts, Chief Financial Officers (CFOs), and legal practitioners will be critical to understanding the practical implications of the reforms. While finance teams can provide guidance on technical and operational matters, the legal team should assess and explain the potential risks and consequences of non-compliance with the new tax provisions. Once this knowledge is gathered, HR has the responsibility to cascade the information to all employees, translating complex policies into clear, relatable language. When employees understand the reforms in simple, everyday terms, they are more likely to feel confident and engaged. It is therefore crucial to promote financial literacy across organisations. Sensitisation and engagement sessions should begin well before the implementation date of 1st January 2026, ensuring that employees at every level, from management to junior staff, are fully informed. Early communication will make understanding easier and reduce confusion when implementation begins. Employees should also understand that HR is working alongside them in this transition. The reforms will affect both employees and businesses, and HR must act as a strategic partner, balancing employee experience with organisational performance.

As HR leaders champion initiatives that enhance employee understanding and engagement, they must also ensure these efforts align with broader business goals. By improving employee experience while supporting profitability, HR helps create organisations that truly embody the Great Place to Work philosophy. Employees should start reflecting on how these reforms might affect their take-home pay. The government has played its part by introducing the reforms and setting the policy direction. It is now up to employees to explore ways to minimise their tax burden and take advantage of potential opportunities.

HR professionals and business leaders should also start exploring effective ways to engage employees and identify measures or incentives that can help achieve mutual understanding and alignment. Organisations currently preparing their 2026 budgets and projections should begin factoring the possible impact of these reforms into payroll costs. It is also the right time to engage company leadership and the board in discussions about what lies ahead. Employers should explore ways to cushion the impact of these changes so that by 2026, they can introduce incentives or support systems that motivate employees and show genuine care for their well-being

How federal tax changes impact employees in the workplace

The impact on employees can be described as a state of psychological uncertainty about what lies ahead. Regarding changes in federal taxation, everyone must assess how these adjustments will affect them personally. While it is suggested that middle- and low-income earners may enjoy some tax relief under the new rates, the real question is how they intend to utilise those savings. Although the reforms may create some uncertainties, they also present potential opportunities. High-income earners, for instance, can engage tax professionals to help them establish efficient tax structures. Looking at certain provisions of the Act, individuals with higher disposable income may find a few advantages they can leverage. However, one major concern lies in the implementation phase. While the law may appear sound on paper, it is only during execution that its effectiveness becomes clear. Based on previous simulations, there are often nuanced issues that emerge during implementation, areas the legislation might not have fully addressed, leading to possible disputes. Therefore, individuals within the higher income bracket should begin having strategic discussions with their tax advisers on how best to optimise their tax positions.

Strategies HR can put in place to reduce the anxiety or misinformation about tax changes spreading among employees before the effective dates commence

Anxiety and confusion tend to increase when there is misinformation. Therefore, HR’s role should be to lead the enlightenment process by reviewing the Nigerian Tax Act and collaborating with the finance team or tax consultants to extract key insights on how the reforms will impact employees. These insights can then be shared through short, engaging formats such as videos, infographics, or practical scenarios that make the information easy to understand. Communication can be done through regular updates, either daily or weekly, via email. Teams can also be encouraged to discuss the reforms during designated sessions to deepen understanding and relate the changes to their work and personal situations. Such informal or semi-formal learning approaches will significantly ease implementation, as employees will already be informed and prepared when the reforms take effect.

How HR professionals can collaborate with the finance and legal teams to ensure smooth integration of these tax changes

It is essential for HR professionals to stay updated on new developments within the country that may affect employees. Organising knowledge-sharing sessions where finance and legal teams engage directly with employees allows staff to ask relevant questions and gain clarity from experts. HR should take the lead in facilitating this collaboration, ensuring a clear understanding of the issues at hand. Even when financial or tax experts use technical language, HR plays a crucial role in simplifying and interpreting the information in a way that employees can easily understand and trust. When HR professionals enhance their access to information, deepen their knowledge, and increase awareness, they become better equipped to collaborate effectively across functions.

Now more than ever, HR needs to strengthen relationships with business leaders, as their support is vital in communicating and driving organisational alignment. HR must also manage the change process around the tax reforms carefully to prevent misinformation and misinterpretation, recognising that employees may perceive messages differently. Additionally, HR can work with IT teams to create visual reminders, such as graphic messages displayed on employee laptops, to reinforce awareness of the upcoming reforms.

Beyond payroll: HR’s role in supporting employees during financial uncertainty caused by tax reforms

This is the perfect time for HR to showcase their creativity and bring to life those innovative ideas that have long been on hold. One effective initiative would be to introduce Employee Assistance Programmmes (EAPs), designed to support employees in managing the changes brought about by the tax reforms and helping them identify practical ways to cut unnecessary expenses. HR clinics could also be organised with external experts in wellness and employee well-being to guide staff on maintaining financial and emotional balance. Even if organisations choose to adjust salaries upward in response to the reforms, it is equally important to help employees understand that this is not the time to increase personal spending. In addition, organisations can partner with financial advisors to educate employees on smart investment choices, cost management, and financial planning, enabling them to live better and manage resources more effectively. Ultimately, the tax reform should be viewed as an opportunity to reposition organisations as both people-focused and business-minded. When stakeholders see HR striving to balance empathy with strategic business priorities, they are more likely to support and champion employee assistance initiatives that help individuals adapt to societal changes while still achieving their personal goals.

Why taxes influence workplace morale so strongly

When it comes to taxes, employees are naturally concerned. Any reduction in take-home pay, no matter how small, can cause anxiety and impact motivation. Considering the escalating cost of living in Nigeria over the past 18 to 24 months, where costs have increased by approximately 300 to 400%, many employees are already struggling to meet their financial obligations. The introduction of new tax reforms that further reduce take-home pay will inevitably affect them.

Many employees mistakenly believe that management can influence the amount of tax deducted from their salaries. This misconception highlights the need for clear communication: the taxes employees pay are dictated by government policy, and compliant employers have limited control over the amounts. Once employees understand this, their perceptions and attitudes toward management will shift. Equity perceptions also play a role. Employees often compare their situations in the formal sector to colleagues in less regulated or informal sectors, which can lead to frustration. Organisations need to address this frustration by clearly explaining the legal requirements, compliance obligations, and the next steps the company is taking.

Employers should also identify opportunities within the law, such as allowable expenses or deductions, to help cushion the impact of tax changes. By actively engaging employees on these measures, organisations demonstrate that they care about their workforce, which can boost morale. Without proper information, employees may hold incorrect beliefs that the company controls their taxes. Transparent communication, coupled with innovative, lawful strategies to mitigate the impact of the reforms, is essential to support employees and maintain motivation.

How internal policies or handbooks should be updated for compliance with the new tax requirements

Policies serve as clear documentation of how things should be done within an organisation. Regarding taxes, these policies must align with the law of the land. The first step for organisations is to pause and determine their position on embracing the new tax reforms, considering the impact on their employees. Once leadership has taken a stand, decisions on any necessary changes can be made. Organisations should then communicate these decisions in a transparent and easy-to-understand manner, emphasising that the reforms are here to stay. Stakeholders should also be engaged to explore possible ways to cushion the impact.

Potential areas for organisational review may include:

- Salary restructuring

- Updating benefits and deductions policies

This process should be approached as a proper change management initiative.

Conclusion

The new federal tax reforms present both challenges and opportunities for organisations and their employees. While these changes may create initial uncertainty and anxiety, they also offer a chance for HR to lead strategically, promoting financial literacy, enhancing engagement, and aligning compliance with employee well-being. By proactively communicating, updating policies, and collaborating with finance and legal teams, HR can help employees navigate the reforms confidently while safeguarding morale and productivity. Ultimately, organisations that approach this transition thoughtfully, balancing empathy with business priorities, will not only ensure compliance but also strengthen trust, motivation, and organisational resilience as Nigeria moves into the new fiscal era.

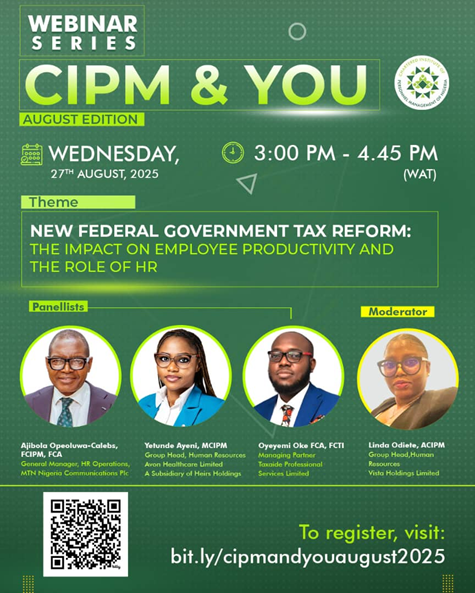

This thought leadership piece was adapted from the August 2025 edition of the ‘CIPM and YOU’ webinar and represents the opinions of the panellists during the session.